Crypto Resistance spells End of an Empire

(Be sure to watch the above video, or click this link. It cost our marketing department a fortune in Galactic Credits and they are very proud of it)

Long, long ago, in a land called Cryptopia

When BostonCoin first started out, our mission in the whitepaper was simple: to “provide returns which are comparatively safer than investing into a single coin, listed company or stock index”.

We did not aim to exceed returns from other coins, we did not aim to reinvent the wheel, and we did not aim to depose Bitcoin, the undisputed “king of crypto”. We aimed instead for less volatility, and bringing a balanced portfolio of cryptocurrency to the masses.

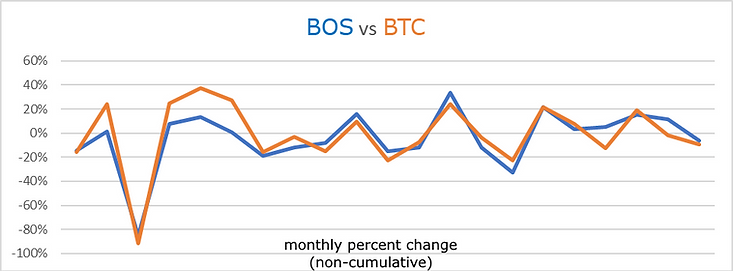

In the two-year chart below, you can see that the BostonCoin (BOS — blue line) has not necessarily made the highest of highs compared to Bitcoin (BTC — gold line). Nor has it made the lowest lows.

Month by month, BOS has aimed to provide a gentler experience for its investors than the rollercoaster ridden by BTC maximalists.

When BTC hammered down 92% in mid-2018, BOS only dropped 85%. Both coins recovered towards early 2019, and when markets turned sour in mid-2019, BTC dropped 15% whilst BOS only shed 8%.

In the recovery of December 2019, BTC surged up 24% whilst BOS powered on to gain 33%, a nice little outperformance.

Whilst the coins moved in quasi-lockstep for a few months, there was also some occasional outperformance. In April 2020, BTC lost -12% whilst BOS gained +5%, and in July 2020, BTC dropped -2% whilst BOS added +12%.

As many investors and crypto buffs will know, over 90% of coins which were released in 2017-2018 went to zero; for reasons ranging from mismanagement, lack of planning, bankruptcies to outright deliberate scams.

We aim to emulate the best practices in crypto and finance, plus we aim to educate our investors, so that the pitfalls of this new asset class do not affect you. You and your friends can choose to invest into a diversified and safer asset such as BostonCoin, or you can choose to try your luck by investing yourself. Either way, choose a well-diversified portfolio, and use the safety rules laid out in the “C.O.I.N.” method at www.Cryllionaire.com

Wealth Diversification prevents Wealth Eradication

The importance of diversification has been raised by thousands of investment gurus for hundreds of years. In late 2020 we have seen dozens of major world corporations diversifying some of their cash holdings into cryptocurrency.

These corporate entries into crypto have included around half a billion dollars from Greyscale, $415 million from MicroStrategy, $900 million from asset manager CoinShares, plus other smaller players, for a total of over $7 Billion invested into crypto since August, from firms in Wall Street and London.

Perhaps going forward, we may see many companies eschewing central bank controlled paper currency and investing into other cryptocurrencies, such as BostonCoin. If the major corporations are wise, perhaps they will follow where you and your fellow BOS investors have chosen to lead. In time, the resistance will grow.

What else is news in cryptopia?

First, bitcoin was just for geeks and nerds. Then bitcoin was for revolutionaries and (alleged) criminals (although 99.3% of crime is still conducted in USD). Then bitcoin became mainstream for investors, with a huge swathe of other cryptocurrencies entering the fray.

As quarantine continues, some people claim that the entire pandemic is a hoax designed to cover up activities of Hollywood paedophiles or some other type of #pizzagate conspiracy. We do not listen to Russian trolls, Chinese hackers, fake social media accounts or conspiracy theories. We look at the facts and figures. If 99% of scientists in the world agree that COVID19 is a real disease, who are we (as non-scientists) to argue with them? We simply do not have enough expertise to argue, and if we are wrong, our ignorance may be deadly.

Meanwhile, when hundreds of companies are closing down, laying off workers or going bankrupt “due to Covid”; we, as expert economists, may look at them with a sideways and quizzical glance.

For the truth is, there were hundreds of corporate failures in 2018 and 2019, long before the disease broke out. Quarantine may have accelerated the snowball, but online sales have been eroding bricks & mortar retailers for many years. Many corporations racked up huge and unsustainable debts, without considering that bad things can happen. Large companies were bailed out by taxpayers in 2008 when they should have been left to fail. No lessons were learned, it was the fattest and not the fittest who survived GFC1.

In 2019/2020, world central banks and governments have predictably reacted just as they did during GFC1 in 2008, by dropping interest rates and handing out stimulus cheques. But GFC2 is different, in that interest rates were already low (where to go now but negative?) and the governments handing out fiscal stimulus are still carrying heavy debts from last decade.

Do not trust someone who offers you money, who also happens to own the printing press

Satoshi created a specifically scarce and finite bitcoin as s/he witnessed a sick world, drowning in debt and the original COVID08 (Creation Of Virtually Infinite Dollars, 2008).

Not only would bitcoin be a currency that would bypass the banks, returning profits to the people, but it would also be a storage of wealth which could not be devalued or debased by central banks printing more paper currency.

After many years of being collected by nerds, geeks, doomsdayers and financial weirdos, crypto has finally become adopted by large worldwide corporations.

Huge financial management companies such as Grayscale and PayPal have given the billion-dollar green light to cryptocurrency (and effectively given the middle finger to central banks).

Ten years ago, you could argue with your nerd friend that “bitcoin isn’t real money”. Nowadays, it is hard for you to argue with a multi-billion-dollar multi-national corporation who just exchanged billions in cash for digital coins.

The people whom you trust to look after your superannuation, 401k or retirement investments have started to buy cryptocurrency. The companies who transfer trillions of dollars every day into hundreds of countries are now buying, holding, using or accepting cryptocurrency.

The revolution continues, and crypto prices will go up for two reasons:

1) more customers are buying and using the asset, and

2) the old-fashioned central banks are still spreading COVID08 (the Creation Of Virtually Infinite Dollars).

Paper currency will devalue corporately as more and more paper fiat is printed by central banks, with no asset backing. Paper currency will devalue among the population as interest rates on bank deposits go below zero (or below inflation). Scarce commodities such as gold, silver, diamonds, land, cryptocurrencies and art will go up in value. Of these scarce commodities, only crypto can be sent and received instantly, or safely transported across borders without detection. This will become much more important in future years; count on it.

If you do not yet have a crypto wallet, be sure to get one. If you already have a crypto wallet, the future of money, quite literally, is in your hands.

Keep your keys and codes secure, backed up and available to others only in the event of your death or serious illness. Accumulate what you can, and keep your investments a secret. A foolish man will brag in the street about his safe full of gold, only to return home and find himself robbed. A wise man will say nothing and he will stay wealthy and wise

The exception to the above rules is this: Do not tell your closest friends how much BostonCoin you have, as even a good friend will steal when they are desperate. But absolutely DO tell your five closest friends you have “some” BostonCoin, as we all want more investors buying to make the price higher, and remember, we often give cool BostonCoin swag to those who refer friends

This month’s winners include the crypto OG (Original Granddaddy) bitcoin, a newcomer to the “blockchain agnostic” space, PolkaDot, and one of our favourite DeFi tokens, ChainLink. For more on DeFi, earning up to 11% on your deposits, and why “Banking 3.0” may kill off the banks’ business models, refer to BOS Update Aug-Sept 2020 and BOS Update Sept-Oct 2020

Choose wisely, hold nicely. Good puppy

This month:

PolkaDot up 102%

WANChain up 105%

Bitcoin up 137%

ChainLink up 952%

Celsius up 3041%

Luke & Leia’s team resisted the Empire of Sith and won their freedom. The Boston puppy pack resists the empire of central banks and wins freedom for all. Plus it chooses its weapons wisely and has enough “real” money left over to buy lunch afterwards for all its friends.

Stay safe during COVID19: wear a mask, wash your hands, do not lick doorknobs on public buildings. You will get through this.

Stay safe from COVID08: get a crypto wallet, avoid ambitious promises, scams and “shiny object syndrome”. Only buy good quality coins which you can “HODL” for the longer term. You will be safe from hyperinflation (aka: “the monster in debasement”) and your grandchildren will thank you.

BOS is up 11% this month. Tell your friends 🙂

Take care, puppy pack

See you next month

NAV 30/10/2020

40.7817994

BOS Price 44.8599