Bulls strike upwards, bears slash down

Most of us remember 2017/2018 when crypto rocketed into the public view, emerging from the secret domain of nerds and geeks to arrive in newspapers and on TV. There was great fanfare and excitement for almost a year, as Bitcoin and Ethereum prices were discussed on the evening news and at morning bus stops. Then suddenly, it was all over, as bulls took over, crypto markets crashed and the long “crypto-winter” began.

Those who had jumped into crypto markets purely on speculation and greed were halted in their tracks, and complained loudly to anyone who would listen. But those who were in crypto for the revolution stayed silent and strong in their beliefs. When crypto markets go south, true believers accumulate more crypto as ammunition for the revolution, or just HODL and wait.

We were not first to the party, but early enough. The Boston puppy pack have held strong through seven out of the last twelve crypto crashes, and have ultimately come out on top. We believe in the revolution and the disruption of this new technology. Just as taxis and hotels were ripe for disruption by Uber and AirBnB, the broader financial industry has for too long favoured themselves and ignored their customers. Sooner or later, the tides turn.

Bitcoin pizza, crypto cars and more

Early use cases for crypto were nerds sending funds to each other for services such as programming and graphic design. The first “real world” transaction to a third-party was when Lazslo Hanyecz paid 10 000 bitcoin for two pizzas on May 22nd 2010.

May 22nd is now celebrated each year as “Bitcoin Pizza Day”, when news outlets report exactly how much those pizzas cost Laszlo at today’s prices, and thousands of crypto enthusiasts go out to their favourite pizza place and try to buy pizza for bitcoin. (Yes, more and more restaurants are coming on board).

A decade later, and Laszlo has no regrets. The pioneering pizza-loving programmer still has plenty of bitcoin left over, and prices have continued to soar now that crypto is accepted in the ‘real world’.

It has only been a couple of months since world’s richest geek Elon Musk decided to park some of Tesla’s cash reserves into crypto as a defence against bank fees and government inflation. Famously this lead to a big spike in price and the news that Tesla had made more gains from holding bitcoin for a month, than the company had made in 14 years of selling cars.

Musk has since announced that Tesla will accept BTC as payment for its vehicles. This made many people think that the savvy billionaire is manufacturing electric cars not to save the planet, but to accumulate more crypto, and become not just mega-wealthy, but Bond-villain private-island Mars-realty rich.

For the past few centuries, many of the world’s wealthiest families have made their fortunes from oil and banking. Tesla disrupted oil to the point where every other major car company is having to catch up. Mercedes, BMW, Toyota, Volvo, Jaguar and others are now coming out with electric, hydrogen or hybrid models.

Crypto disrupts banking, insurance and other financial services, and we now see major financial institutions in a mad scramble to catch up. Paypal, Square, Visa and Bank of America offer crypto services. Grayscale financial has accumulated an eye-watering 654 000 bitcoin, and has launched dozens of crypto investment services.

For those who do not want to go to the bother of having their own crypto wallet on their phone, Grayscale offers a mono-investment bitcoin trust, as well as individual ones for BAT, Bcash, ChainLink, Ethereum, Filecoin, LiteCoin, XLM and XRP. One would wonder why investors would bother investing into a so-called managed fund which only has one asset, instead of just buying the asset themselves, but who are we to question the market?

If Grayscale can bring in $100 billion into these products, and charge a hefty fee for ‘managing’ a solitary asset, then the market for such services must surely exist, no matter how much we disagree with it.

The BostonCoin Pizza

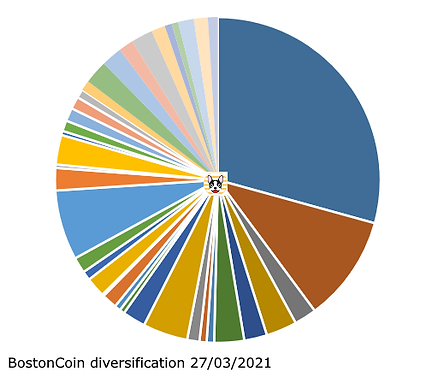

This conversation about mono-funds, diversified funds and pizzas can now come neatly together, as we show a (pizza) pie chart of the current diversification of BostonCoin. We like our pizza with a little variety, as this is a fundamental rule of successful investing.

During one of the most recent crypto crashes, where crypto-godfather bitcoin dropped 60%, the Bostoncoin diversified portfolio went up by 50%. This is why we diversify: for your safety.

For those who are crypto-curious, the biggest slice of that Bostoncoin pizza is in fact crypto-grandpa Bitcoin, at a smidge over 25% of the portfolio. The adjacent slice is Ethereum, around 11%, which is developing even better protocols for speed, cost-effectiveness and NFT’s. Opposite those two in the lighter blue is Celsius, at around 7% of the portfolio.

Celsius “the UNbank” continues to grow in excellence and value, providing interest for HODL’ers and giving loans to crypto geeks in a more streamlined and cost-effective way than traditional banks. We have been fans since CEL was around $0.06; now it has listed on an exchange for around US$5 and forecasting a possible $10 future price, so we are quite happy about that.

Newbies may ask, “If you can buy a coin for under ten cents and have it grow to $5, why don’t you put ALL your money into that one?” The answer is always the same: Diversification. We love CEL but it is one project. We used to love MySpace and Kodak. If something happens to one project, or if something better comes along, we want to ensure that you and your portfolio are protected with adequate diversification. This is why Bostoncoin is safe, strategic and successful.

Running with the bulls: How did we go this month?

Despite some ups and downs in the market, the puppies powered on. There was a correction as bitcoin temporarily dropped around 13%, with some altcoins dropping more, before a recovery. Institutional adoption of crypto has brought maturity to the markets, so we are still in a nice bull run, and any drops are short and small, as smart investors, as well as big businesses, rush in to buy the dips.

Winners this month included

Secret 190%

SIA 210%

IOTA 212%

POWER 227%

CRO 285%

GOchain 448%

PolkaDot 717%

ChainLink 2 077%

Celsius 10 480%

We continue to monitor the markets for opportunities, either accumulating more during the dips, selling or rebalancing when appropriate, or finding new projects and researching the absolute COIN out of them.

We continue to welcome new investors, including large superannuation or retirement funds, businesses getting into crypto for the first time, and individual investors seeking a balanced crypto portfolio.

Be sure to recommend BostonCoin to your friends and family, share the newsletter with them and be prepared for big things to come. Not only will there be new rewards for investors and new Boston swag for those who share the news, there will be new product offerings coming out soon as well.

Yes, BostonCoin is up almost 25% since last month, and has gained over 500% since this time last year, but there was some volatility along the way, and that was OK for you as a seasoned and savvy investor… but what about others?

What if your grandma wants a nice slow and steady 6% interest every year with no volatility? We will guarantee to take care of grandma, and pay better interest than the bank, with absolutely no ups and downs. Stay tuned for this new offering.

What if your young cousin subscribes to the “YOLO” philosophy and wants to invest into something which could drop 90% in a month or go up 1000% in a month? We will also have an offering for your higher-risk friends. Stick around for that one.

Our flagship medium-risk Bostoncoin investment will always be around, as it has been since 2016. The two new options, “Pollycoin” targeting 6% per year with interest paid monthly and the “DartCoin” higher-risk fund, targeting the moon and paying whatever it can, will launch later in 2021. Expressions of interest will be taken now, if you would like to get in before the ICO date.

Take care, stay safe, and don’t sniff any strangers

See you next month

BOS NAV at 26/03/2021

159.070586

BOS price at 26/03/2021 AU$174.977644

Month on Month increase 23.78%

Year on Year increase 571.31%