Bostoncoin update Feb-March 2023

The big Bitcoin slowdown could mean higher prices

After a few crypto exchanges were found to be not so secure in 2022, many people started to store their cryptocurrency offline (if you have more than $100 in crypto and if you do not already have a Ledger or similar secure device, click here now).

Secure offline storage (or ‘cold storage’) means that nobody can steal your crypto, even if the exchange is hacked or goes bankrupt. It also slows down the selling process somewhat, which can be a very good thing. If your crypto is stored on an offline device, it may take you a few minutes to transfer it to an exchange and sell it.

During that few minutes, you may have *paws* for thought. When crypto is in a ‘hot wallet’ or on an exchange, it can be sold at the press of a button. Sometimes, a piece of news comes out that can cause panic selling. The news often turns out to be a rumour, inaccurate or misleading, and you find out the actual truth minutes, hours or days later.

If you panic sold when the news broadcast “UFOs discovered over USA”, you may regret it later when the UFO turned out to be just a large balloon. (We hope that US military training now extends to heeding the wise words of prophet Nena!)

Whether it be from concerns over bad exchanges, the desire for increased security, putting a pause on swift decisions, or simply holding for better prices after a long bear market, increasing numbers of investors are not selling.

Around 15 million Bitcoins, worth over $370 billion, have been laying dormant for over six months. According to Glassnode and Decrypt, onchain analysis reveals that many Bitcoin investors are now holding for more than 155 days. This behaviour has not seemed to extend to other coins as yet, with Ethereum and other altcoins still being traded rather than held.

The TLDR (Too Long: Didn’t Read) version is that with less Bitcoin being sold, new buyers will have to bid more to entice sellers to part with their assets. As crypto continues its journey to mainstream adoption, and with crypto legislation coming closer, more new buyers are expected to enter crypto markets.

Many more buyers and reluctant sellers may put pressure on prices to move dramatically upwards. As we have seen with previous Bitcoin bull runs, this can drag a lot of other altcoins up with it, ushering in new highs. If you are HODLing, stay strong and resist panic selling. If you are not yet in the markets, this could be your last chance to get in before a massive swing to the upside.

Hong Kong: The Great Bridge to China

Whilst the USA, UK, Australia, Canada and other western nations are looking to launch government stablecoins (Central Bank Digital Currencies or CBDCs) and busily working on new crypto legislation, there is something interesting rising in the East.

China has famously banned cryptocurrency several times in the past few years, but seems to be taking a relaxed stance on allowing Hong Kong to become a major crypto player.

There have been many new projects launched in Hong Kong (some ostensibly based in Singapore), with undoubtedly more to come. We will mention a few companies that may lift mass adoption in Asia: (note these are *not* recommendations. As always, do your own research; DYOR)

1. Wombat Exchange. Seemingly missing the opportunity to use a cuddly Asian panda as their mascot, the company aimed instead for the large Aussie marsupial. Wombat allows users to swap coins of one type (eg. Binance BNB) into another (eg. TUSD) at reasonable rates. Half of the fees generated are retained by the company, with the other 50% of fees shared with holders of their token. Launching around the $1 mark, the token price dropped to $0.10 and has been slowly creeping back up.

2. Conflux. An interesting project that aims to assist the permissionless transfer of value across borders, over several networks. The software is open source, meaning that anyone can work on it and improve it, with users voting on changes. The network recently switched to a hybrid Proof Of Work/ Proof Of Stake (POW/POS) model, seemingly to gain the best parts of both Bitcoin and Ethereum. Conflux is currently the only regulatory-compliant network used in China, and has signed deals with the City of Shanghai, McDonald’s China and China Telecom. Blockchain-enabled SIM card anyone? After hovering under $0.10 for much of 2022, the Conflux token has recently peaked as high as $0.30.

3. AlchemyPay. As the name suggests, Alchemy enables users to transform their fiat currency into cryptocurrency like lead into gold. Merchants and other business owners have the option to accept crypto as payment and turn it back into cash. A simple but effective solution, Alchemy has recently connected with Visa, Mastercard, Apple Pay and Google Pay. After sitting between one and two cents for much of 2022, AlchemyPay is now around $0.04

4. Filecoin. This unique project was profiled on the Cryllionaire website several months ago, so click here if you want a quick overview. Filecoin competes with Amazon Web Services, Google Drive and Dropbox, by allowing peer-to-peer file storage. Stored files are encrypted on someone else’s computer, so they cannot see your material, and the storer pays the storee using the native token. The price has been between $5-$8 for the last year.

5. Sandbox. A gaming token where players can sell in-game assets for real-world money. There are a few of these games around, so choose wisely if you’re into that. After peaking around $8, and plummeting to $0.40, SAND tokens are now up around $0.80, having recently signed deals with Adidas and Snoop Dogg. Around $200 million in SAND changes hands every 24 hours; gaming is much bigger than many people realise.

6. Mobox. Another game platform that offers a variety of experiences, from farm-type games, battle games and even one for romance. Earned assets can be bought and sold using the MBOX token (not to be confused with MmmBop, the indefinable moment that probably doesn’t exist). After peaking around $13, MBOX has been under $0.60 for many months. Trading volume is only around $6M per day but this may increase with new players entering the arena.

Veronica Jin and the case of the disappearing banknotes

Still in the East, the Bank of Japan (BOJ) has announced it will be trialling a Central Bank Digital Currency (CBDC) as soon as April this year. It seems that the tech-heads have been working on this project for two years now (and possibly watching the CBDC rollout in China, currently leading the world with its digital yuan).

The digital yen is being trialled by three of Japan’s largest banks, as well as a few regional banks, before being released to citizens and businesses. Even slow progress is still progress, and we are guessing that Japan wants to iron out all the wrinkles before going public.

In addition to China, other countries that have already launched CBDCs include the Bahamas, Jamaica, Nigeria, and eight countries in the Eastern Caribbean (Anguilla, Saint Kitts & Nevis, Antigua and Barbuda, Montserrat, Dominica, Saint Lucia, Grenada, Saint Vincent & the Grenadines).

Planned CBDC rollouts are scheduled for 17 countries later this year: Ghana, South Africa, Saudi Arabia, Singapore, Malaysia, Thailand, Hong Kong, South Korea, Iran, Ukraine, Sweden, Russia, Kazakhstan, United Arab Emirates and Australia.

There are a further 33 countries that are currently in CBDC testing and development phase, including the USA, Brazil, Indonesia, Canada, the UK and Europe. Digital dollars will be coming to a nation near you, so be prepared to ditch your leather wallet or purse.

The name is Bond, Digital Bond…

In Germany, mega-corporation Siemens has issued a $64 million bond on the blockchain, using the Polygon network (MATIC). Fans of the feat mentioned that using the blockchain removes the requirement for a central clearing house (like a stock exchange or bond exchange) and with zero paperwork, makes things more efficient and secure.

This comes after European Investment Bank issued a $100 000 digital bond with Goldman Sachs, Swiss Bank UBS issued a $370 million bond and ABN Amro released their own digital bond in January, for $450 000.

Despite lambasting digital currencies such as Bitcoin and Ethereum, the International Monetary Fund (IMF) has praised the benefits of blockchain technology, including encryption, tamper-proof tokenisation of assets and programmability.

Of course, the IMF wants the world to use the CBDCs that they issue and manage; IMF heads have pleaded with El Salvador to stop using Bitcoin as legal currency. It will be interesting to see who wins that battle. Be prepared to hear more about de-dollarisation as an act of independence or an act of war, and comparisons to the Boston Tea Party that led to America seceding from England. If El Salvador does not comply, it may lose the auspice of the IMF, but perhaps, if Bitcoin emerges stronger in 2023, El Salvador may not need the IMF at all. Watch this space for a new precedent (or a new President).

What are we up to?

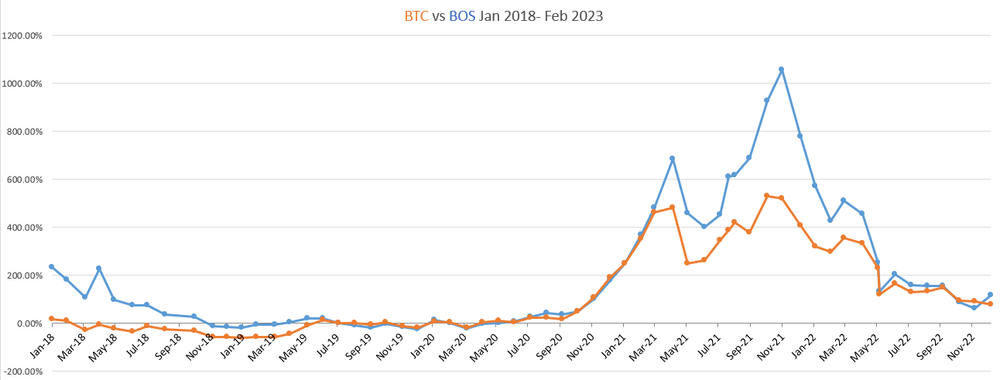

As always, the Boston team continue to comb the markets for value, and scour the news for any exciting titbits. Sometimes we learn something new and act upon it, many other times we do not. Because our job is to keep our finger on the pulse, we find out many new things long before it’s mainstream, which is why we profiled Filecoin (FIL) several months ago and already purchased Sandbox (SAND). This is also how we managed to make gains of over 10 000% on no less than six (6) different coins in the BOS portfolio.

Whilst Bitcoin made gains of around 45% earlier this year, the DART portfolio was up 53%, and the Bostoncoin portfolio continues to exceed the Bitcoin benchmark by a few percentage points as well.

The original Bostoncoin Whitepaper was denominated in AUD and published in English, Mandarin Chinese and Indonesian. We are now denominating in AUD and USD and hope to reach more markets with our great crypto funds. If you know a significant number of people who speak another language, let us know and we can assist your friends with a new translation. We are always at your service: making crypto investment safer and simpler for all.

Feb 28 2023

BOS NAV 65.1595731AU

BOS Price 71.6755304AU

BOS NAV 44.9601041US

BOS Price 49.4561145US

Feb 28 2023

DART NAV 97.4735948AU

DART Price 107.220954AU

DART NAV 67.2567785US

DART Price 73.9824563US

see you next month

JB